There is a growing demand for crypto market makers, who can help new cryptocurrency projects gain listings on major exchanges and attract investors. This article will explain why market makers are necessary before a crypto project can be listed. Listed assets are prone to price volatility, and they need market makers to help them reach the desired price. To make money with crypto, a token issuer must be able to attract a large enough volume of investors to justify the price.

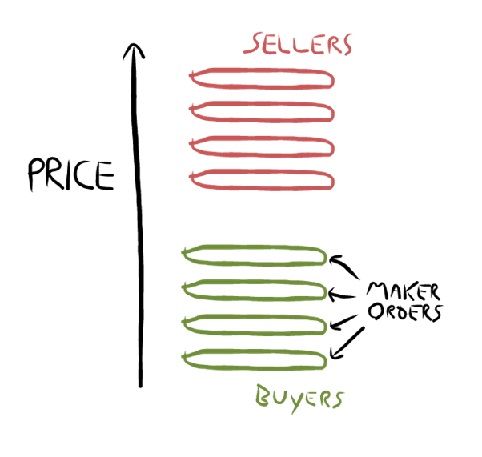

Liquidity is essential to any trading venue. Without it, exchanges would be ineffective. Therefore, market makers are essential to the functioning of exchanges. Unlike brokers, market makers do not receive commissions from trading in cryptos. They provide trading volume to investors, and their services are critical to the market’s health. If a crypto exchange lacks enough liquidity, it will be unable to sustain itself. Without market makers, the development of an exchange will slow or even cease. Without a reliable market maker, its competitive edge will be compromised.

As the number of institutional investors in the crypto space increases, so does the need for crypto market makers. To that end, the growing availability of market makers is encouraging more institutional money into the crypto industry. In addition, robust market making is creating new possibilities for the crypto industry. But how does a crypto exchange choose a market maker? Well, first, it’s important to know who they are dealing with. This is not a list of all cryptocurrency exchanges, but rather an introduction to some of the most important market makers.

ICO market makers take on risk in the hope of profiting. Because the assets are volatile, market makers should be aware that their risk is largely dependent on whether or not a market maker can find buyers. Similarly, if a market maker is motivated by volume, he or she may sell too early when prices are rising. This risk increases dramatically with crypto assets, as they are more volatile than conventional alternatives. Most crypto exchanges operate offshore, sidestepping regulations and government oversight.

To make an ICO project stand out in the market, a token issuer needs to work with a market maker. These professionals specialize in the technical aspects of crypto market making. They can help an ICO get listed on an exchange and avoid liquidity issues. They can help a new project raise capital by offering more volume in exchange for its tokens. As a result, ICOs will have greater leverage to negotiate for secondary listing on exchanges.

Automated market makers are essential to a decentralized exchange. The decentralized exchange will eliminate middlemen, reducing the need for centralized exchanges and related market making practices. The technology behind these automated market makers has been around for years, but its benefits have only recently been realized tech deck ramps. In the end, they are a critical component of the decentralized exchange ecosystem. And now, they’re making a big impact in the world of crypto-assets.